Raising Money

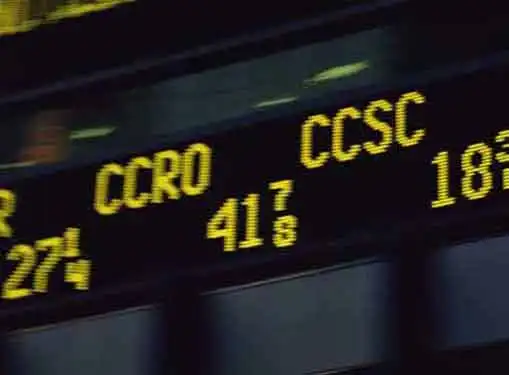

Direct Public Offerings

It's easier than you think to go public. Direct public offerings help companies raise money by selling their shares directly to their own affinity groups.

Investment and financing are critical to the success of any small business.

But since finding the funds you need when you need them is no easy task, some entrepreneurs have taken their quest to the streets with something called Direct Public Offerings (DPOs), a creative financing stream that is becoming increasingly popular for small business owners.

Like an Initial Public Offering (IPO), a DPO is a stock offering that encourages outside investment in a business.

However, a DPO is much less complex and less costly than an IPO, making it more attractive for small businesses and more achievable for the average small business owner.

Here's how it works: After completing a simplified registration process with SEC, the small business begins to recruit an affinity group of investors from its base of customers, employees, distributors, etc. Investors receive equity in the business in exchange for their investment.

The business, on the other hand, receives an influx of capital and the loyal support of its investors, who now have a personal stake in the company's success.

Like any business transaction, DPOs have both pros and cons. Here are some the things you need to consider before jumping into a DPO of your own.

Advantages of a DPO

The most obvious advantage of a DPO is that it provides capital resources outside of the traditional lending process. With a DPO, you don't have to worry about lengthy loan applications or monthly payments. Compared to an IPO or other publicly traded stock offering, a DPO also requires a smaller equity surrender for the same of amount of capital investment. So in a sense, a DPO can offer the best of both worlds.

Even more, a DPO creates a built-in incentive for the people in your affinity group to work with you to make your business profitable. This can ultimately lead to a cascade effect in which customers, employees, and business partners open doors and create connections that might otherwise have been out of reach. The key is to recruit investors who are capable of playing a catalytic role in your company's future.

Disadvantages of a DPO

Although a DPO is simpler than an IPO, it still involves a fair amount of work and commitment to pull off. The SEC registration process is not a slam dunk and will require a significant effort to complete. But once you've registered DPO, your work has just begun.

The next step involves recruiting investors, and to do that you will need to conduct an effective PR and marketing campaign to potential affinity group members, demonstrating that your company is worth the investment. All of this takes time and money, and there is no guarantee that anyone will be willing to invest when it's all said and done.

But if they do invest, you may be faced with another downside. If the business fails to meet your investors' expectations, you'll have to answer to the people you rely on everyday - not faceless investors.

If you aren't prepared to deal with the fallout, then you may want to consider pursuing an alternative form of financing.

Share this article

Additional Resources for Entrepreneurs

Conversation Board

We greatly appreciate any advice you can provide on this topic. Please contribute your insights on this topic so others can benefit.